Since February, investment markets experienced greater volatility than any other time in history. The initial market sell-off has been subsequently met with an extraordinary rally in equity markets. What has this meant for the performance of your superannuation fund or investment portfolio? We look at some popular super funds used in the public sector along with benchmark returns for different asset classes financial year to date.

How Have Investment Returns Faired Financial Year to Date?

It is easy to get swept away in both the panic and euphoria of media reports on financial market returns. One only needs to look at a few news headlines over recent months to gauge the range of emotions:

- ASX crashes below 6,000 with almost $140b wiped off in worst day since global financial crisis (ABC news 9th March 2020).

- ASX wipes more than $160 billion in worst session in history after coronavirus rattles financial markets (Nine news 16th March).

- Global recession fears see $60 billion wiped from Australian stock market (ABC 15th April).

- ASX claws back losses to end flat, after Dow Jones sheds 1,200 points in two days amid oil meltdown (ABC 22nd April).

- Global Stocks Rise, Buoyed by Reopening Hopes (Wall Street Journal 26th May 2020).

- Australian shares jump to 11-week high with investors hopeful about COVID-19 recovery (ABC 26th May).

Part of the sensationalism in reporting on investment markets is achieved by looking at recent ‘peak’ periods, those where the markets have reached a recent high and ‘troughs’ those where the market have reached recent lows. Such analysis is rarely very useful as returns should generally be looked over the longer-term.

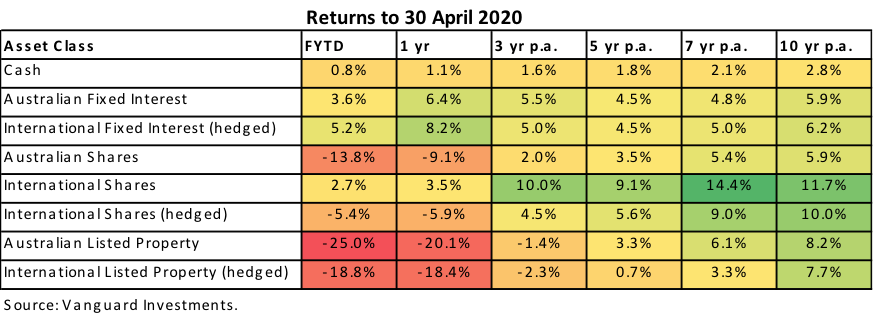

Even over shorter periods such as financial year to date (FYTD) returns are starting to look a lot less scary than recent peak to trough returns. Buy way of example the Australian share market and international share markets both peaked on 20th February 2020 and both reached new lows on 23rd March 2020. For this period, of just 36 days both markets were down approximately -36%. To the end of April markets sustained significant recoveries with Australian shares down a lesser -14% and international shares (hedged to AUD) down just -5.4% FYTD. Unhedged international shares are even up 2.7% FYTD due to a falling Australian dollar.

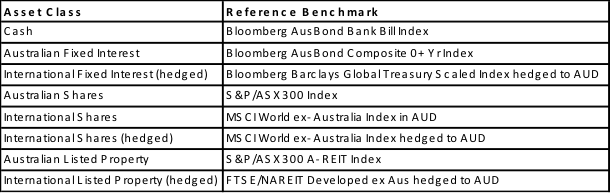

The below table provides returns for various assets classes to the end of April 2020:

BOOK A COMPLIMENTARY INITIAL CONSULTATION

If you have an investment portfolio or self-managed super fund (SMSF) the recent investment volatility has provided a ‘shake-out’ of poorly performing assets, investment managers and investment strategies. It is actually the ideal time to objectively assess long-term asset allocation, manager selection and strategy.

We often find expensively managed investment portfolios fail to outperform or hold-up as well as overall markets and simple low-cost strategies. If you would like to discuss how we can assess the performance of your investment portfolio or SMSF and improve relative performance outcomes moving forward whilst reducing management costs, please book an initial consultation.

What Has This All Meant for Superannuation Returns?

Superannuation returns are simply a function of:

- market returns

- asset allocation

- individual investment manager outperformance/underperformance (alpha)

- unlisted asset holding returns

- fees

- tax

The main driver however of superannuation fund returns though are the first two points market returns and asset allocation, the percentage of the superannuation portfolio invested in each market.

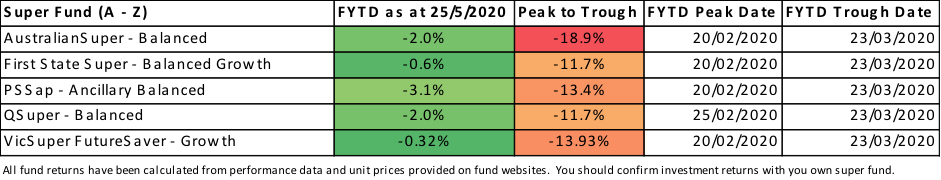

I have selected the below super funds to look at for no other reason than they are commonly used amongst public sector employees. These funds and their respective returns are as follows:

As one can see, super fund returns have staged a comeback, so the headline returns which have had so many members concerned are not as bad. There are a couple of important considerations and learnings to all this though:

- The returns quoted above are static returns and your own individual returns will always vary if you have made contributions or withdrawals to your super during this period.

- The recovery in markets may be an opportunity for those investors who were genuinely stressed about market movements to reassess their investment risk profile (the amount of money you have in growth assets and defensive assets) and potentially rebalance.

- If you actually need funds in the short-term (1-3 years), to pay off a mortgage at retirement for example, then remaining in a balanced fund or in growth investment assets will place you at risk of not having the capital to meet those requirements when the time arises. You should seek advice.

Killara Wealth works with clients to map their investment risk profile and then selects appropriate low-cost, good performing (in a relative sense) superannuation and investments for clients. We also help clients to manage ‘sequencing risk’. This is the risk of having funds too aggressively invested when they are needed to be drawn upon. In cases of a down market and the need to drawing capital, retirement capital does not have the chance to recover and it can mean a much lower return on your investments throughout retirement.

If you think you may benefit from any of the strategies mentioned in this article, please contact us or book a complimentary initial consultation using the form below.