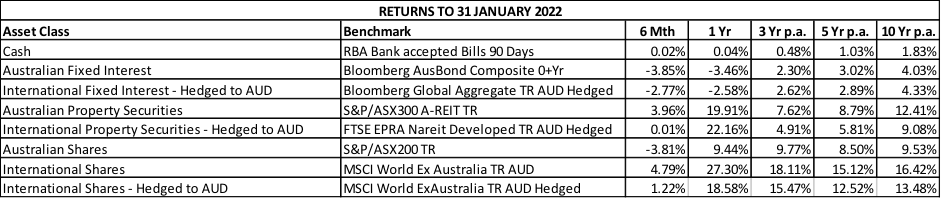

Recent volatility in global share markets has produced short-term negative returns for Australian shares as domestic and global bond markets. Here we look at the longer-term prognosis for shares and why they are likely to remain one of the best places to remain invested. Before we start here is a summary of current market returns for major asset classes:

Inflation is Likely to be Transitory

Currently global inflation is running high and US inflation is at a 40-year high. Inflation can be bad news for stocks in particular growth companies. However, I believe that current inflation is transitory and a result of disruptions to the supply chain brought on by the pandemic rather than fundamental increases in demand. As current supply constraints are worked through it is likely that in the medium-term lead companies will over produce as they seek to make up lost ground and will lose some of their short-term pricing power. Consequently, we could well be looking at a medium-term glut in supply and softening prices with inflation returning to more subdued levels.

A second point is as central banks respond to inflation by increasing interest rates. This will have a deadening effect on longer-term inflation for the simple reason is that western consumers have borrowed extensively at low rates for investments purposes for both property and equities. Higher rates will taper the purchasing ability of these consumers and will lead to a consumer de-leveraging to both sectors.

Energy costs have also increased with petrol prices at record highs in Australia and global oil prices at 7-year highs. High energy prices feed into short term inflation numbers. However, the oil price is currently driven by two factors, one is geopolitical events, namely the Ukraine, the other is reduced production as result of record low oil prices as recently as April 2020 when the oil price actually was negative at -$37 US a barrel. The price of oil tends to overshoot on the downside which disincentivises production, this leads to artificially high prices as demand recovers. This usually results in an oversupply response as the market rebalances supply. This is recently evidenced by increased mobilisation of oil rigs in the US.

Returns From Property Will be Subdued

The buoyant property and equity markets in Australia is one area where we can expect subdued price growth over the 1 – 3 years with the possibility of corrections in property markets particularly regional areas that have been beneficiaries of the move to ‘work from home’. Major capital cities such as Melbourne and Sydney will likely remain insulated from major price corrections underpinned by a resurgence in immigration but may experience some modest price declines over the next two years.

Employers are starting to insist on employees return to work for at least a portion of the week. This makes the planned retreat to a farm or coastal area more logistically challenging than previously thought by workers. Initially the work from home experience for employers saw a spike in employee productivity. However as time passes and employees become more relaxed about working from home the initial productivity gains have been eroded resulting in employers seeking to recommit their workforce to the office.

A migration back to the office however may not necessarily translate into increased demand for office space. Anecdotally, large and mid-size employers I have spoken to in Sydney and Melbourne markets have cut their floor space by 20 – 30% and subletting is common. They do not intend to increase their footprint rather manage with less through rotating their workforce and hot desking.

For the above reason the office sector remains high risk and a glut of office space is likely to persist for several years. Retail property should also be avoided as there has been a fundamental shift to online retailing which is unlikely to fully unwind. One bright area for property remains logistics and industrial sectors however these have both rallied strongly and are now full priced.

Another driver of lower property returns is relative yields. As cash and bond rates increase the relative attractiveness of the property sector for its income attributes wanes. This is further exacerbated by the end of super cheap money for financing purposes. With investor borrowing rates as low as 2% over the last 2 years there was a plenty of incentive for investors to gear into property where rental yields funded borrowings.

Lenders are now actively pursuing over-leveraged property investors for plans on how they intend to deleverage and forced property sales, particularly in the residential sector, are likely to occur. Further, I have come across plenty of anecdotal evidence of lenders requiring borrowers who are approaching retirement to provide plans for the repayment of their interest only investment loans.

Why Bond Returns are Negative and What Should I do?

Increased bond yields have pushed returns from this asset class negative over the last 12 months by -3.5% for Australian fixed interest and -2.6% for international fixed interest. Whilst many people do not expect negative returns from bonds this can happen from time to time as bonds are marked to market and their capital valuations adjusted. This is expected to be a short-term phenomenon as rising rates are unlikely to produce negative total returns over the medium and long term, given the longer-term inflation outlook and secular forces that should keep long-term rates low.

In most cases I am advising clients to remain invested in their fixed income portfolios as the yields from these portfolios remain preferable to cash, returns should normalise and the negative returns experienced absorbed by higher yields relative to cash over time.

Shares Remain the Preferred Asset Class

Remaining invested in equities is preferable to parking too much money in cash or bonds. The Australian market remains attractive as it is underpinned by the highest dividend yield of any developed market. Once franking credits are included the gross yield of the Australian market as measured by the S&P/ASX200 is over 5% meaning if share prices do absolutely nothing one can still expect a 5% return. Current cash rates at 0.1%, even if these are progressively increased to say 3%, remain unattractive relative to equities.

Expected economic growth rates both domestically and globally remain robust with forecasts for Australia in 2022 at 4.3%, US 4%, UK 5.5% and China 5%. Strong economic growth usually translates into increase company earnings and share price appreciation. The Australian market has lagged the performance of the US and its outlook

In Summary, What is Our Tactical Asset Allocation?

For clients we remain underweight property redirecting this exposure to additional Australian and International equity holdings. For cash we are tending to only hold just enough cash for clients to meet their liquidity requirements in the short-term and redirecting this exposure to quality active and passively managed fixed income portfolios. Whilst we remain advocates for a large proportion of client funds to be managed passively for the tax, return and fee benefits this provides, we expect fixed income to remain challenging. So, for clients with low-risk tolerances and high defensive asset exposure requirements the additional cost of actively managed fixed interest portfolios is justifiable in the current environment.