At present the world is awash with bad news both economically and geopolitically. The two are currently inextricably linked. Despite headline inflation figures continuing to shock markets prompting central banks into panic responses with sledgehammer rate hikes the drivers of inflation this time are unlikely to be tamed by the blunt instrument of monetary policy. Essentially, there are three things that could occur for inflation to be put back in its box and for markets to recover. Obviously one is the cessation of the war in the Ukraine. The second is the freeing up of the global supply chain and the third is a reduction and stabilisation in energy prices. So how likely are these to occur?

War in the Ukraine and energy prices

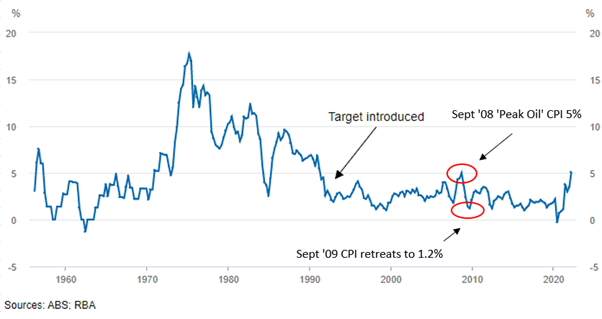

Military experts have varied takes on the outcome of Russia’s aggression, but all agree that it is unlikely that Ukraine will be subjugated by Russia particularly with the welcomed solidarity of the Europeans along with the support of the USA, UK and other western democracies. Over time the painful decoupling of Europe from its reliance on Russian energy will occur. Other global energy exporters will continue to ramp up production and step into this void and energy prices will correct. One only has to cast their mind back to May 2008 where there was talk of ‘peak oil theory’ and an oil ‘super spike’ with some predictions including from Goldman Sachs that oil was heading to $200 USD/Bbl. In June 2008 oil peaked at $140 USD/Bbl before retreating to $41 USD/Bbl seven months later in January 2009:

Supply chain bottlenecks will ease

Another driver of inflation is supply chain bottlenecks. On 27 March, authorities in Shanghai began a lockdown of the city’s 26 million residents as part of China’s zero COVID strategy. Shanghai also happens to be the busiest port in the world making it a good barometer for global growth and a proxy measure for global supply chain issues. The measure being number of cargo ships waiting to load or discharge at Shanghai Port. By the end of March this had peaked at over 600 ships compared to an average of 300 ships for the same time of year over the last five years. It had the makings of a great story the only thing is Shanghai Port waiting times have now returned to normal. Australia’s own Reserve Bank of Australia Governor, Phillip Lowe also expects pandemic-induced supply chain disruptions to ease and points to the increased production in chip manufacturing and cars as current examples.

Recent data from the US also shows that US Wholesale Inventories are rebuilding up 2.2 percent in April and 24 percent year on year. Wholesale inventories are the stock levels that wholesalers have in their warehouses and an increase in inventories is an indicator of slowing consumer demand and increased production. Similarly, US Domestic Auto Inventories are also showing signs of rebuilding up 8.2% in April albeit off an historically low base.

Normalisation of monetary policy

The recent rate hikes in the US and Australia are necessary to bring monetary policy back to a more even keel and should be viewed as a normalisation of interest rates rather than the fear of some that inflation is now baked in for the long-term and we are heading for persistently higher interest rates over the longer term. If we analyse what Janet Yellen, US Treasury Secretary, told Senators on 7 June she led with the United States was dealing with “unacceptable levels of inflation” but she also said she hoped price hikes would begin to subside and inflation would be coming down. The headline US inflation number of 8% is scary however if food and energy costs are excluded it is running at 4.9% and edging lower.

The Reserve Bank

The Reserve Bank of Australia surprised everyone with its 0.50% rate hike on Tuesday 7th June responding to Australia’s March annual inflation number of 5.1%. However, bringing rates up to 0.85% is not aggressive but a path to normal. Interestingly the RBA expects inflation to peak in the second half of this year at 7% before declining back towards a 2 – 3 percent range “as the global supply-side problems are resolved and commodity prices stabilise, even at a high level, inflation is expected to moderate.” Probably, the most disappointing and surprising thing for markets and mortgaged consumers is the RBA’s jettisoning of its commitment to keeping rates low at 0.10% through to 2024 and until Australia saw real wages growth. Interestingly though, some analysts such as UBS Australia’s chief economist are predicting the RBA will be cutting rates again by late 2023. The Australian consumer after all is the most leveraged to house prices and mortgage rates in the developed world.

The below chart shows rolling annualised inflation by quarter. Interestingly in September 2008, in the aftermath of the GFC inflation peaked at a similar level of 5% in response to the above mentioned spike in energy prices before retreating to 1.2% a year later.

Why we are not looking at a 1970s stagflation scenario

We are not looking at a worst case scenario of stagflation which the world has not experienced since the 1970s. I recently came across an interesting article by Gareth Hutchens, a business and economics reporter for the ABC. In this article he states five compelling reasons why we are not facing 1970s type stagflation. Firstly, policymakers and central banks have learned their lessons from the 1970s. In fact, stagflation in the 1970s is one of the most studied modern economic phenomena. In the 1970s economic modelling could not handle the concept of stagflation because it was simply considered an impossibility.

Secondly, we are now living in a neoliberal era. From post WW2 to the early 1970s Australia’s economy was built on the concept of genuine full employment. Government’s during this era would panic if unemployment rates ran close to 3 or 4 percent and targeted an unemployment rate of 2%. It is now accepted that unemployment can run higher to keep a lid on inflation. So whilst unemployment is now considered low at 4% it is still double the targeted rate of 2% post WW2.

Thirdly, stagflation began with real wage increases and it was necessary. There were two important decisions that led to real wage increases for women. In 1969 there was the Equal Pay decision which established the principle that women who perform equal work alongside men should receive equal pay. Up until this point legislation allowed employers to pay women 25% less than their male counterparts for the same work. In 1972, there was a second equal pay case widening this principle in line with the International Labour Organization’s Equal Remuneration Convention. This resulted in women being awarded the same rate of pay as men as long as the work was comparable in value. This resulted in a one off structural increase in wage growth during the 1970’s.

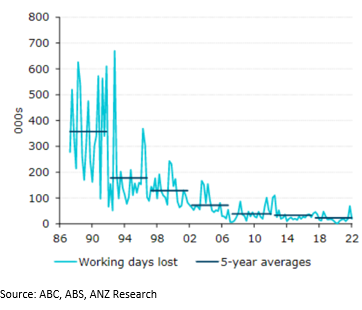

Fourthly, the industrial landscape is different. The wage setting mechanisms of the 1970s have been dismantled. Further, so has collective bargaining. In the 1970s approximately half of employees were union members. Today that level has shrunk to about 14%. The ability to demand material wage increases through industrial action has become difficult. The below chart depicts total working days lost to industrial disputes. There has been a 71 percent decline since 1986:

Finally, the financial system of the 1970s was rigid with pegged exchange rates, capital controls and policymakers in charge of devaluing or revaluing the dollar to control exports, imports and manage inflationary pressures. The Australian dollar peg to the UK pound and subsequently the US dollar was disbanded in 1974 in favour of a trade weighted index. Finally, in 1983 Paul Keating floated the Australian dollar allowing market forces to self-regulate the flow of capital and regulate economic growth and recovery through the pricing of imports and exports.

Things are bad but not a bad as we think

Inflation has been a shock, particularly after three decades of benign inflation, however we are likely to see inflation tamed due to a progressive reduction in supply bottlenecks, lower energy prices and subdued consumer demand as a result of rate hikes. This is unfortunately regardless of the how protracted the war in Ukraine becomes. However, we all hope for a just outcome to this conflict. The sooner this occurs the better it will be for financial markets and there will be further downward pressure on inflation and interest rates. It is unlikely we will see a lost decade to stagflation as some may remember from the 1970s and it is important to remember that we have already experienced the inflation shock of higher energy prices. It is for these reasons we should expect a reduction in inflation by the first quarter of 2023. Similarly, we should expect a normalisation of interest rates around the same time or perhaps earlier. And rest assured, if central banks have got this all wrong, they will be in a better position to once again ease monetary policy, as some are already predicting.