The RBA announced its third 0.50% rate increase earlier this month and its fourth rate rise since May 2022. For many borrowers there is now a level of anxiety around how far interest rates will climb and how to manage increasing repayments. Here are some simple tips on mitigating these increases, as well as some perspective around the current rate cycle. We also take a look at the rates we think clients should be paying on their mortgages.

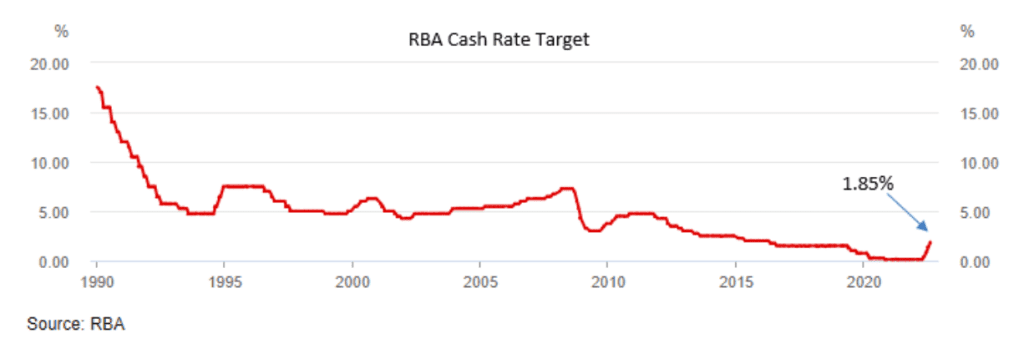

Interest Rates Still at Historical Lows

Despite the ferocity of rate increases from the RBA, the current cash rate of 1.85% is still near historical lows. The average cash rate over the last 20 years has been 4% with the average standard owner occupied variable mortgage rate over the same period being 6.35%. The below chart maps RBA interest rate movements over this time:

Rates are likely to increase further before they are expected to ease in 2023. Actively managing your mortgage situation now whether it is refinancing, building an additional buffer, extending the loan term or employing a number of other strategies to handle higher rates will make things easier as higher rates challenge borrowers. Waiting too long before reviewing your mortgage strategy may become problematic for the following reasons:

- Lenders are increasing their servicing rates. The servicing rate is the interest rate applied when calculating loan affordability for a borrower. Essentially it is a worst case scenario that needs to be passed for a loan to be approved. I have recently seen examples of loans approved a few months ago that would not be approved now due to changes in serviceability rates.

- If you enter into a period of mortgage stress this will impact your ability to refinance. Missing mortgage or other loan repayments not only impacts your credit score but any new lender will require an explanation as to why this occurred. The irony of mortgage stress is once you start missing repayments you’ll probably end up stuck with a less competitive interest rate with lenders unwilling to refinance.

Refinancing

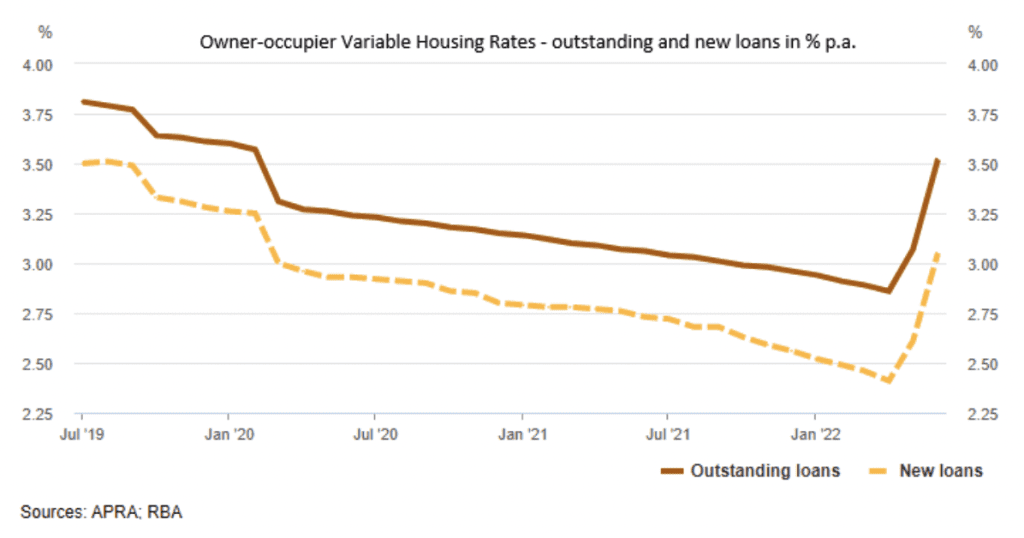

Refinancing is usually one of the best ways to save and manage rising rates…

The average variable outstanding residential owner occupied mortgage rate in Australia, in June, was 3.52% compared to new loans in the same class at 3.05% (RBA & APRA, June 2022). This difference of close to 0.50% is persistent over time and can be observed in the following chart:

There is a large amount of mortgage complacency in Australia. People generally don’t bother to refinance or worse have a misplaced loyalty to their existing bank. I frequently encounter scenarios where borrowers are paying 1 – 1.5% over more competitive mortgages available. Ironically new bank customers are offered more competitive rates than what loyal borrowers have been paying for many years. Unfortunately, often the only solution to redress this is to actually proceed with a refinance elsewhere and when the loan refinance settlement is finally scheduled those loyal customers will receive a call from their bank ‘retention team’ finally offering a more competitive rate.

So refinancing may shave off around 0.50% from your current rate and if you haven’t refinanced in a while, greater savings may be had.

Consider Your Loan to Value Ratio (LVR)

Your loan to value ratio (LVR) is likely to be lower than when you first took out your mortgage…

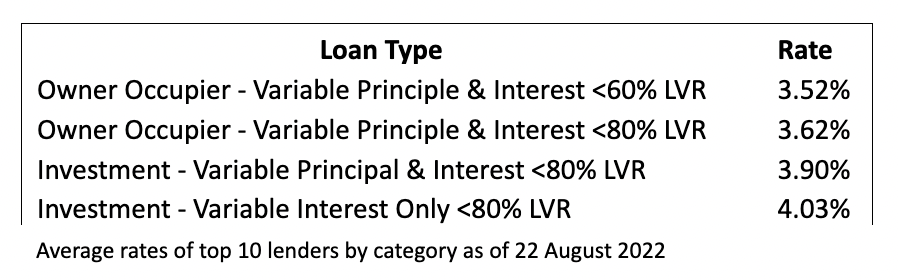

Most lenders will loan up to 80% of the value of a property before requiring lenders mortgage insurance (LMI). However, the lower the LVR the more competitive an interest rate is likely to be from a lender. Referring to Killara Wealth’s panel of lenders, the average rate of the top 10 most competitive lenders for a $1m loan with a LVR of 60% or less comes in at 3.52% compared to 3.62% for loans with an LVR of 80% a saving of 0.10%.

Chances are, through a combination of property price increases and ongoing mortgage repayments, most people’s LVR will have reduced since they first took out their mortgage. If this means that your LVR is now below even 70% additional savings may be achieved through refinancing.

Competitive Mortgage Rate?

So, what is a competitive mortgage rate in the current market?

With the number of recent rate increases and lenders continually adjusting their published rates at different times it is easy to lose track of what actually constitutes a competitive mortgage rate in the current market. Killara Wealth uses a panel of over 50 lenders for clients. We look at the 10 best mortgage rates for each main category and use the average of these to determine what ballpark rate clients should be paying:

Killara Wealth Mortgage Broking

Killara Wealth has direct access to, and can compare, thousands of different products from over 50 lenders including all the major banks to ensure our clients get the most competitive home or investment loan based on your situation. By comparing loans, we can arrange for the most competitive loan available for you often saving 0.5 – 1.5% on your current or future mortgage. For further information please visit Mortgage Broker Services – Killara Wealth or Contact Us.