INVESTMENT APPROACH

As a privately owned business with no institutional alignment, Killara Wealth has a broad ability to advise on and recommend investments. This means I can give my clients access to best in breed investment products across all superannuation environments (SMSF, retail, industry and government) as well as underlying investment opportunities for each asset class. Killara Wealth has access to, and can advise on, an extensive range of investments including:

- All types of superannuation funds – industry, government, retail and SMSFs

- Exchange Traded Funds (ETFs)

- Managed Funds

- Direct Equities

- Bonds

- Cash

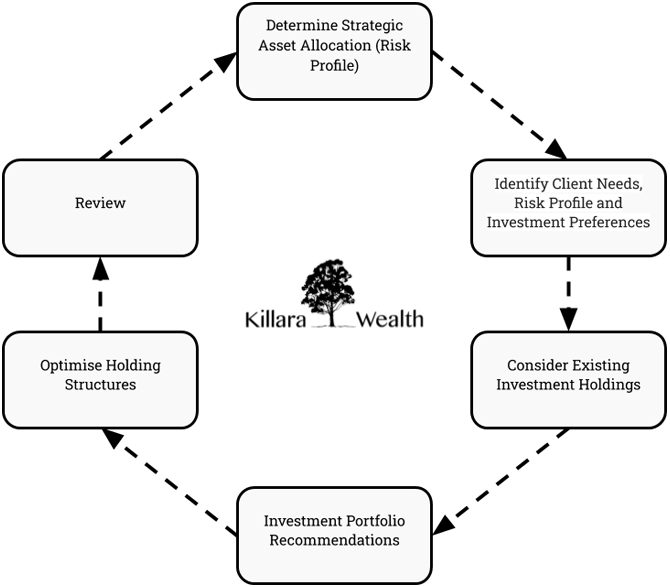

For all of my clients, the same rigorous portfolio construction and investment selection process is applied. This can be summarised as follows:

1. DETERMINE STRATEGIC ASSET ALLOCATION

Your strategic asset allocation is the percentage of your portfolio exposed to underlying sectors such as Australian shares, international shares, property, cash, fixed interest etc. We do this by:

- Reviewing your risk profile i.e. what is your tolerance for negative returns in the pursuit of higher investment returns?

- Discuss with you your risk profile and whether this is realistic for achieving your goals. Is it too conservative for a superannuation portfolio to be invested for the next 20 years to fund retirement income? Conversely, you may have accumulated sufficient capital and you do not need to take as much investment risk to maintain your lifestyle and achieve your goals.

2. INVESMENT PREFERENCES

- You may have a preference to retain a particular investment holding or super fund.

- You may prefer not to invest in particular types of companies such as tobacco, gaming, alcohol or only invest in companies with a particular environmental, social and governance profile.

3. CONSIDER EXISTING INVESTMENT HOLDINGS

- Considering your existing investments and whether they should be retained as part of your recommend investment portfolio.

- In some cases existing investments may meet your requirements or have other benefits, particularly in the case of superannuation funds, such as life insurance or access to a guaranteed pension when you retire.

4. BUILD RECOMMENDED INVESTMENT PORTFOLIO

Applying our core investment principles, we then develop your investment portfolio recommendations.

5. OPTIMISED HOLDING STRUCTURES

- At the minimum, most clients will have at least two entities in which to consider holding assets, individually or through superannuation. For many clients though, further consideration needs to be given to asset holding structures including discretionary trusts, investment companies and transfer of assets to spouses.

- I will recommend which assets should be held in which entity to determine the optimal tax efficiency of holdings reflective of asset class characteristics such as income and capital growth as well as other considerations including utilisation of assets for collateral or alternative holding structures for asset protection.

- Appropriate portfolio management accounts with the features required by you at a competitive cost will be recommended. Alternatively, I may recommend you hold assets directly through a share trading account or through a superannuation fund such as an industry, government, retail or self-managed super fund.

6. REVIEW

Critical to the success of any investment portfolio is regular review. Reviews are necessary to ensure asset allocation remains as intended, to maintain the liquidity of a portfolio for upcoming planned expenditures and to ensure investments are performing as expected. Dependent on the type of portfolio recommended I will recommended an appropriate review schedule for your investment portfolio.

To arrange a complimentary 15 minute discussion on how I can help you secure and manage your financial future please, contact me.