New rules for superannuation concessional contributions came into effect this financial year. As a CSS or PSS member, what do these changes mean for you?

From 1 July 2019 concessional contribution ‘catch-up’ provisions allow you to make additional tax-deductible contributions to superannuation. In some cases, this could save you thousands of dollars in tax and provide a healthy boost to your superannuation for retirement. It also opens several opportunities to manage the timing of superannuation concessional contributions to maximise your superannuation benefits.

What are Concessional Contributions?

Concessional contributions are those amounts contributed to superannuation before tax and may include employer superannuation guarantee contributions, employee salary sacrifice contributions, or those other contributions individuals make to superannuation for which they claim a tax deduction.

In most cases concessional contributions are taxed at 15% when they reach the superannuation fund which means significant potential tax savings for individuals as follows:

| Income Range $ p.a. | Tax Rate including Medicare | Concessional contribution tax for super | Potential tax savings |

| $18,200 -$37,000 | 21.0% | 15% | 6.0% |

| $37,001 – $90,000 | 34.5% | 15% | 19.5% |

| $90,001 – $180,000 | 39.0% | 15% | 24.0% |

| Over $180,000* | 47.0% | 15% | 32.0% |

*For individuals, whose income and concessional super contributions are in excess of $250,000 there may be additional Division 293 tax payable on super contributions of 15% bringing total tax on super contributions up to an additional 15%.

CSS and PSS Considerations

Historically there has been an annual $25,000 cap applied to concessional contributions for each financial year. Importantly for CSS and PSS members their employer ‘productivity contributions’ and ‘notional contributions’ count towards this cap and should be checked with your super scheme before embarking on any superannuation contributions strategy.

CSS and PSS members will need a separate accumulation super account to make concessional contributions into as the CSS and PSS schemes are unable to accept member concessional contributions. Killara Wealth has a well-researched list of suitable low-cost funds that it can recommend to clients.

BOOK A COMPLIMENTARY INITIAL CONSULTATION

Enter Catch-up Concessional Contributions

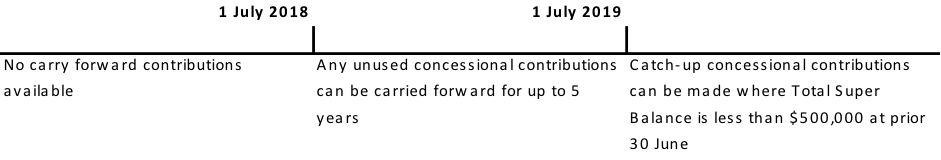

From 1 July 2018, the amount of concessional contributions $25,000 cap unused can be carried forward for up to five years:

To be eligible to make catch-up contributions your Total Superannuation Balance (TSB) must be less than $500,000. Your TSB is the combined balance for all super funds you hold as of 30 June of the previous year. Check with your fund or funds what they have recorded as this amount. You also need to be eligible to make contributions to superannuation. For recent retirees aged between 65 and 74 special rules apply and the TSB limit is reduced to $300,000. Seek advice for details.

Strategies to Consider Utilising Catch-up Contributions

There are several strategies that can be utilised dependent on an individual’s circumstances including:

- Single year catch-up contributions

- Review current salary sacrifice arrangements to time these super contributions with the disposal of assets subject to capital gains tax (CGT) such as a rental properties or other investments

- Spouse contributions splitting. Your partner may have lower concessional contribution amount and a larger cap to take advantage of. Up to 85% of concessional contributions made in a financial year may then be transferred to partners.

- If you or a partner operates a small business or has variable taxable income, consider the use of catch-up contributions to smooth income and tax liabilities over multiple financial years.

Making additional concessional contributions though salary sacrifice, or deductible contributions can be a smart way to build additional superannuation. If you think you may benefit from any of the strategies mentioned in this article, please contact us or book a complimentary initial consultation using the form below.