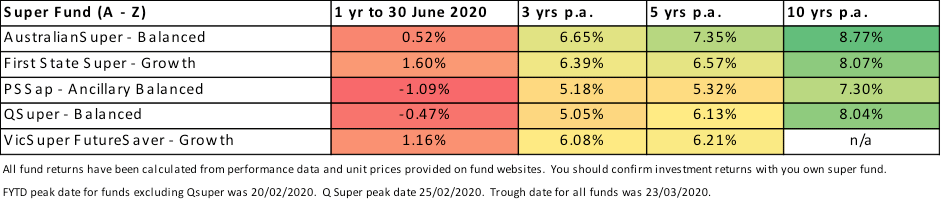

Since my last newsletter in May, there has been a further recovery across asset classes to varying extents. International and Australian shares continued their strong recovery. This has boded well for superannuation fund returns which also continued to improve with some eking out positive results for the 2020 financial year. Here are the returns of some common superannuation funds used amongst the public sector:

Longer Term Focus

Stay focused on the longer-term but be aware of short-term needs and invest accordingly.

Whilst short term returns are likely to have disappointed investors longer-term returns from funds still hold up well. Here at Killara Wealth our long-term return assumptions for a balanced portfolio is 6.5% p.a. and a growth portfolio 7.0% p.a. and have been achievable for clients invested in well managed, diversified, and low-cost superannuation funds.

However, if you have money invested, whether inside or outside of superannuation, and you are likely to need these funds in the short to medium-term (0 – 5 years, for example to pay-off your mortgage at retirement or for planned expenditure for children or home renovations), then look closely at how you are investing your money. There are no guarantees that there will not be further market volatility, in fact it is almost certain. If you are likely to need funds in the short-term then that proportion of your investment or super portfolio needs to be invested more conservatively.

An integral part of our financial planning process at Killara Wealth is to identify the short and medium-term cash flow needs of clients and then construct their portfolios accordingly. This ensures that there is capital invested securely to meet their requirements over medium-term whilst also investing for growth over the longer-term to provide future income and protection from the effects of inflation throughout their retirement.

Diversification is the Only Free Lunch

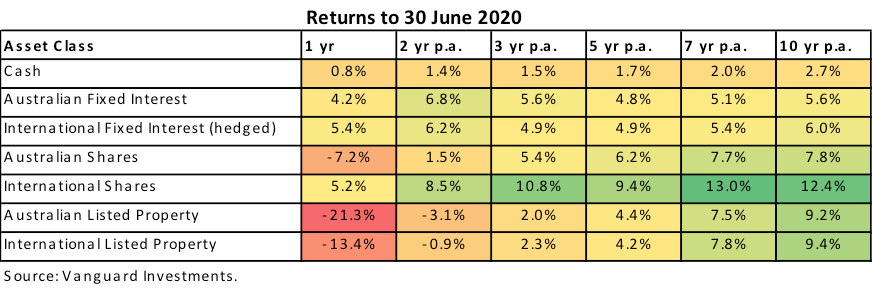

The below table provides returns for various assets classes to the end of the financial year 30 June 2020, and gives an indication of the volatility different asset classes can experience:

As one can see, listed property has experienced some dramatic negative returns over the last year. This is not surprising given the ability of commercial tenants to pay rents throughout the lockdown periods and the continued challenges the retail sector will face in a struggling economy, as well as the changing demand for office space around the world as more companies move their employees to working remotely.

Property has often been viewed as a secure investment by Australians and certainly over the longer term it has performed well. However, in the investment business we have a saying, “diversification is the only free lunch.” Investors with well diversified portfolios with limited exposure to property (around 5 – 10%) and a reasonable exposure to international shares and fixed interest have faired better than less diversified portfolios heavily weighted toward property and Australian shares.

Do Not Try to Time the Market

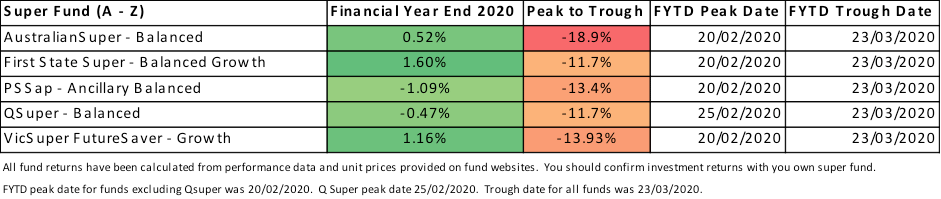

I have previously written about the perils of trying to time investment markets. During the initial outbreak of COVID-19 stock markets declined by more than 30% in March. This was followed by huge rallies in April and May. In many cases markets are now back or nearing their previous all-time highs, particularly in the USA. Superannuation funds had correspondingly large falls. As one can see, super fund returns have staged a comeback, so the headline returns which have had so many members concerned are not as bad. Getting asset allocation right in your portfolio and staying the course is usually the best action as can be demonstrated in the following table:

For investors that try to time the market COVID-19 has been a hugely volatile and potentially costly ride. At Killara Wealth we prefer to take a much more cautious approach, a key part of investment planning is protecting wealth for clients as well as sustainably growing their investments over the long term.

In Summary

So, what is the takeout of all of this?

- Be aware of your short-term cash needs so you are not forced to sell an investment which has just declined. Have enough secure assets to last you in the medium term, this will give you time for markets and investments to recover.

- Stay focused on the longer-term. Returns from a well-managed diversified portfolio will recover.

- Diversify, diversify, diversify. Specific assets classes may seem safer to invest in but being diversified is the best way to manage risk. A portfolio just of cash, property and Australian shares is not a well-diversified portfolio.

- Do not try to time the market. Markets are volatile because no one really knows what event may cause markets to crash or rally. You may get lucky in the short-term, but chances are you will progressively destroy your investment capital longer-term trying to time the market.

To review your superannuation and investment portfolio, map out your future cashflow requirements and build a resilient portfolio please contact us and book in an initial free phone consultation.