One of the most common catalysts for CSS members to seek professional financial advice is when they are approaching their 55th birthday. The question they seek to resolve is whether a 54/11 is appropriate for them? Many just assume that 54/11 provides the best option but this is not always the case and there are a lot of variables to consider. This article will explain the difference in calculations between a CSS 54/11 and Age Retirement as well highlight the key considerations when weighing up your options. We will wrap up the article with a practical example and highlight the type of advice we provide CSS members in these circumstances.

When can a 54/11 be Accessed?

54/11 involves resigning from a CSS contributing employer just prior to your 55th birthday (for some limited occupations this may be your 50th birthday). The CSS benefit becomes ‘preserved’ and accessible as a pension once you have reached your CSS preservation age which is usually 55. Another scenario where the 54/11 calculation can be applied is there is a redundancy from a CSS contributing employer after the age of 55.

The first point to note is the CSS preservation age i.e., the age at which you can access your CSS benefit is different to the standard preservation ages for superannuation where persons born after 1964 generally cannot access their superannuation until age 60. For CSS lump sum components, taken as a lump, rather than a non-indexed pension, these preservation rules may apply.

How is a 54/11 Indexed Pension Calculated?

An important point to note is that the calculation of a 54/11 does not consider at all your Final Salary or Length of Service. Rather the indexed pension is calculated as follows:

(Basic Contributions + Earnings) x 2.5 x Age Based Factor = Lifetime indexed pension

Basic Contributions and Earnings are your standard CSS contributions of 5% plus investment earnings on those contributions. These are either invested in the CSS Default Option (a balanced type of fund) or the CSS Cash Option.

Aged Based Factors – for ages 55 to 65 are as Follows:

| Age CSS Benefit Claimed under 54/11 | Factor |

| 55 | 0.0925 |

| 56 | 0.0940 |

| 57 | 0.0955 |

| 58 | 0.0970 |

| 59 | 0.0985 |

| 60 | 0.1000 |

| 61 | 0.1020 |

| 62 | 0.1040 |

| 63 | 0.1060 |

| 64 | 0.1080 |

| 65 | 0.1100 |

How is the CSS Age Retirement Indexed Pension Calculated?

The calculation of the indexed pension under Age Retirement is contingent on three variables:

- Final Salary

- Length of Service

- Age of Retirement

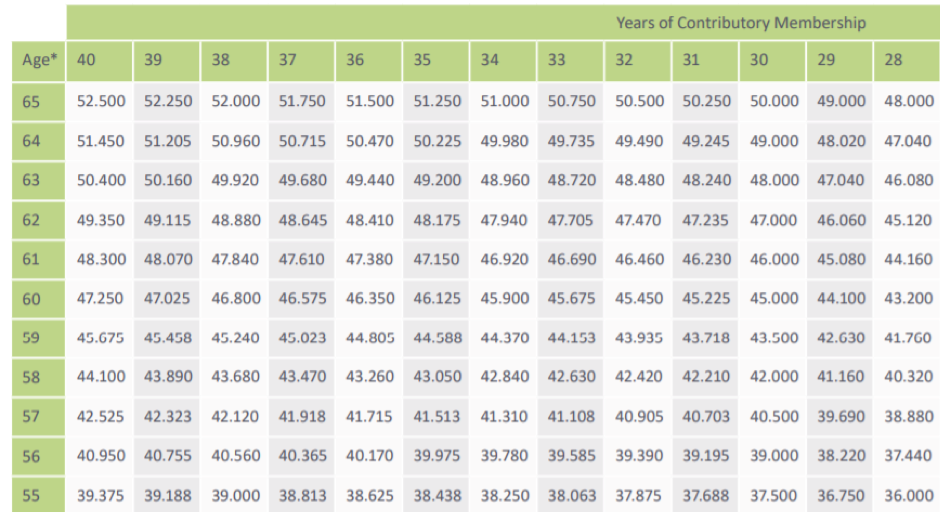

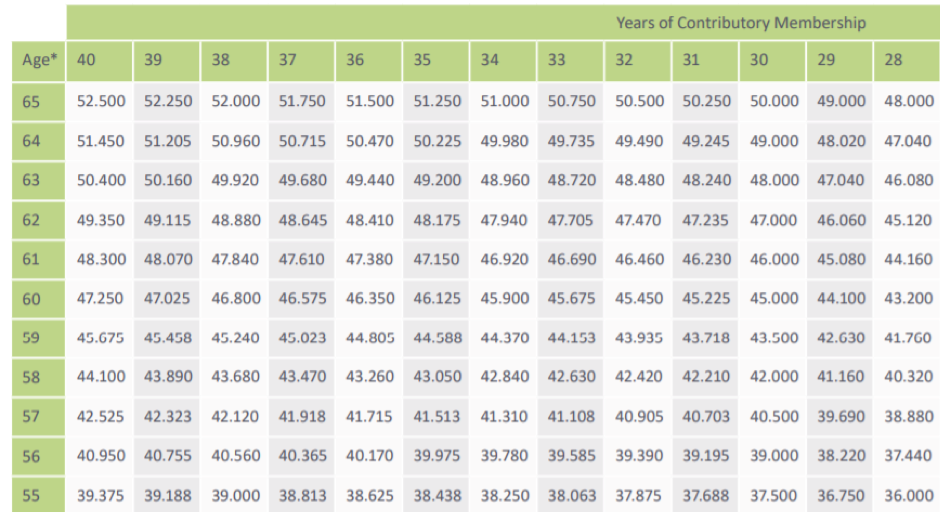

The CSS provides a table of factors determined by your Length of Service and Age of Retirement. The maximum factor of Final Salary is 0.525 i.e., the highest indexed pension achievable is 52.5% of your Final Salary. This is only achieved upon 40 years of contributory membership at age 65. The below table provided by CSS provides a sample range of these Retirement Factors:

The calculation for the CSS indexed pension at Age Retirement is as follows:

Final Salary x Retirement Factor

How are 54/11 and Age Retirement Maximum Non-Indexed Pensions Calculated?

The calculation of the non-indexed pension under 54/11 is similar to that of Age Retirement for CSS. The key difference is there is no cap placed on the amount of non-indexed pension you can claim under 54/11 whereas, under Age Retirement, the non-indexed pension will be capped at a percentage of your Final Salary dependent on your age. The pension factor remains the same and coincidentally are the same factors that are applied to the 54/11 indexed pension calculation. They are as follows:

| Age Retirement / Benefit Claimed under 54/11 | Non-Indexed Pension Factor | Cap % of Final Salary for Age Retirement Only |

| 55 | 0.0925 | 18.5% |

| 56 | 0.0940 | 18.8% |

| 57 | 0.0955 | 19.1% |

| 58 | 0.0970 | 19.4% |

| 59 | 0.0985 | 19.7% |

| 60 | 0.1000 | 20.0% |

| 61 | 0.1020 | 20.0% |

| 62 | 0.1040 | 20.0% |

| 63 | 0.1060 | 20.0% |

| 64 | 0.1080 | 20.0% |

| 65 | 0.1100 | 20.0% |

Formula for calculation of maximum non-indexed pension under 54/11:

(Member + Productivity Components) x Non-Indexed Pension Factor

Formular for calculation of maximum non-indexed pension under Age Retirement:

(Member + Productivity Components) x Non-Indexed Pension Factor

capped at a maximum % of Final Salary based on age of retirement any excess can only be paid as a lump sum and may be subject to standard superannuation preservation rules.

Five considerations when assessing 54/11 v Age Retirement

Firstly, contrary to popular views 54/11 does not always provide the best outcome for CSS members. In fact, I have advised many clients over the years to take or plan for an Age Retirement benefit instead. Some considerations in these cases are:

1. An increase in Final Salary

This usually occurs in the case of promotion or job reclassification.

2. Tax

Consider other taxable income you will receive following 54/11. This may be in the form of investment income, income you receive from work after you have left the public service etc. Dependent on the level and type of income received you may be pushed into a higher marginal tax rate. The CSS indexed pension is fully taxable prior to the age of 60. This can erode the value of the benefit and it may be better to wait to age retirement at 60 or onwards.

3. Job Security

Many CSS members plan to claim their 54/11 and then return to work. Dependent on the differential in benefits between 54/11 and Age Retirement it may be better in these circumstances to remain in your current job with the tenure of security it offers and/or the possible prospect of a valuable redundancy rather than retire from the public service prematurely. This is particularly the case where the differential between the two benefits is marginal.

4. Are You Ready to Retire?

Once again, if the differential in benefits is marginal or even if it is not and you are still enjoying work and not ready to retire there may be other strategies that can be put in place. These can include additional non-CSS contributions to super to mitigate the loss in benefits if a 54/11 were taken.

5. Investment Returns of the CSS Default Fund

The 54/11 calculation is contingent upon investment returns in CSS and if you are invested in the Default Option subject to short-term market volatility. People approaching 54/11 should carefully consider whether they remain in the Default Fund or switch to the Cash Option. For example, if there were to be a short-term market correction of -10% in the Default Fund just prior to claiming your 54/11 benefit then there would also be a commensurate reduction in the 54/11 pensions (indexed and non-indexed) of 10%.

Worked Example of 54/11 v Age Retirement

Geoff is 54 years old and has 33 years contributory membership of the CSS. He intends to either resign just before his 55th birthday and claim a deferred benefit (54/11) at age 55. Alternatively, he will consider Age Retirement at 55.

- He is currently employed on a APS6 salary of $90,000 p.a.

- His CSS Member Component is $250,000

- His CSS Productivity Component is $110,000

The 54/11 indexed pension calculation would be as follows:

Member Component x 2.5 x Age Factor

$250,000 x 2.5 x 0.0925 = $57,813 p.a. indexed pension

The 54/11 non-indexed pension would be as follows:

(Member + Productivity Components) x Age Factor

($250,000 + $110,000) x 0.0925 = $33,300 p.a.

The Age Retirement indexed pension would be as follows:

Final Salary x Age Factor

$90,000 x 38.063% = $34,257 p.a.

The Age Retirement maximum non-indexed pension is calculated as follows:

(Member + Productivity Components) x Age Factor

($250,000 + $110,000) x 0.0925 = $33,300

As $33,300 is greater than 18.5% Geoff’s final salary the non-indexed pension will be capped at 18.5% of $90,000 or $16,650 p.a. the balance of his member and productivity, 50% or $180,000 in this case will be paid in the form of a lump sum that will need to be rolled over to another superannuation fund and preserved.

The two benefit options can be summarised as follows:

| Item | 54/11 $ | Age Retirement $ | Difference $ |

| Indexed Pension | 57,813 | 34,257 | 23,556 |

| Non-indexed Pension | 33,300 | 16,650 | 16,650 |

| Lump Sum | 0 | 180,000 | -180,000 |

| NPV* Indexed Pension | 1,734,968 | 1,026,373 | 708,595 |

| NPV* Non-indexed Pension | 714,166 | 357,083 | 357,083 |

| Lump Sum | 0 | 180,000 | -180,000 |

| Total Estimated Value | $2,449,134 | $1,563,456 | $885,678 |

From the above calculations you will notice we have used a Net Present Value (NPV) calculation to estimate the value of each of the pensions. NPV simply discounts the expected future cashflows of each of the pensions. We have assumed Geoff has a female spouse who is also aged 55. An NPV calculation is particularly useful in quantifying the value of each option and ascertaining which one to take. In this case, providing Geoff and his partner reach their average life expectancies then Geoff would be an estimated $885,678 better off taking the 54/11 option over Age Retirement.

Second example – higher salary and working to age 60

Now let us assume a change in Geoff’s situation considering the following:

- He is employed as an EL2 on $150,000 p.a.; and

- He is considering working to age 60.

Here we will provide two additional comparisons Age Retirement at 55 and 60:

| Item | 54/11 $ | Age 55 Retirement $ | Age 60 Retirement $ |

| Indexed Pension | 57,813 | 57,094 | 77,506 |

| Non-indexed Pension | 33,300 | 27,750 | 33,122 |

| Lump Sum | 0 | 60,000 | 449,089 |

| NPV* Indexed Pension | 1,734,968 | 1,710,594 | 1,781,565 |

| NPV* Non-indexed Pension | 7,14,166 | 595,138 | 567,644 |

| NPV* of Lump Sum | 0 | 60,000 | 396,929 |

| Total Estimated Value | $2,449,134 | $2,365,732 | $2,746,138 |

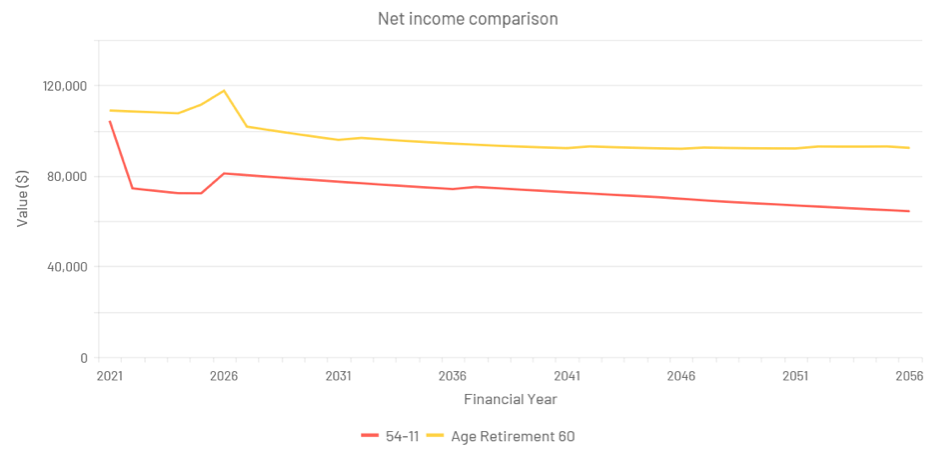

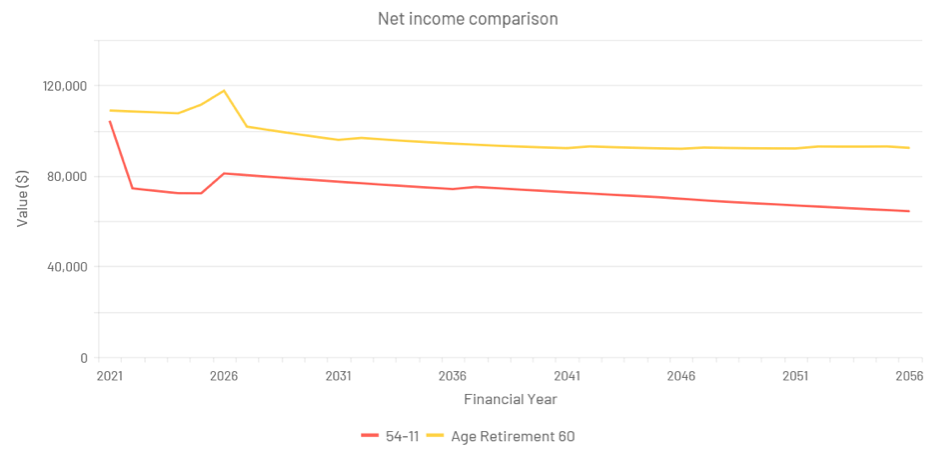

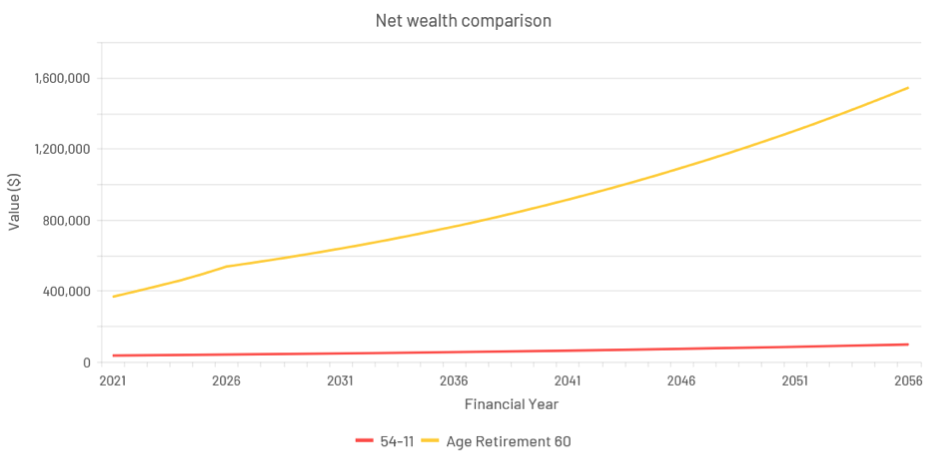

From the above we can see that the 54/11 on an NPV basis is still the best option. However, what is not considered yet is tax and the foregone salary for 5 additional years. Modelling this assuming living expenses of $70,000 p.a. indexed for life and surplus cashflow is invested in a combination of salary sacrifice for Geoff, spouse contributions into super and managed investments we may end up with the following scenario for net income and wealth in present value terms (today’s dollars):

Net Income

Net Wealth

From the above charts we can see that in real terms Geoff will have additional retirement income in today’s dollars of approximately $20,000 p.a. and a net improvement in wealth by over $700,000 by time he reaches age 70.

Conclusion

54/11 may sometimes seem like the best option however the CSS is a complex scheme. Tax, foregone salary, salary increases and future employment prospects are just some of the considerations that require detailed analysis. The above examples are simple but in practice the modelling undertaken for clients can be far more complex and may consider planned lump sum expenditures, part-time work, other superannuation, investments etc. Obtaining professional advice when considering your retirement as a CSS member is a must. As we can see from the above examples making the wrong decision could mean you are tens of thousands of dollars worse off income wise and potentially hundreds of thousand of dollars worse off in foregone net wealth.