ESG stands for environment, social and governance. ESG investing is often used interchangeably with sustainable, socially responsible or ethical investing or other approaches to investing that consider some environmental, social or governance factors.

In my previous roles in funds management, I’ve assisted fund managers become signatories to the United Nations Principles of Responsible Investment (UNPRI) and have had extensive experience advising and voting on company governance issues for top ASX200 companies in Australia. Recently, I’ve have had an influx of clients requesting ESG or sustainable investment portfolios. So, I thought I would pen this article to explain the different approaches available and the opportunities that ESG investing presents in a well-constructed portfolio, as well as dispelling some of the myths associated with sustainable investing.

Different Types of ESG investing

There are many different approaches to ESG investing, but it generally can be allocated into three different approaches; light, medium and dark.

Light ESG Investing

This approach typically imposes moderate ethical restrictions on the types of companies invested in. Usually companies with exposure to weapons, alcohol, tobacco, gambling or adult entertainment are excluded. There may be room however for companies with minor exposures to those industries such as service providers as well as companies involved in the extraction of fossil fuels.

Medium ESG Investing

A more methodical approach is used with this type of investing and will still typically exclude the industries mentioned above along with fossil fuels and nuclear power. However, companies with poor workplace practices, are highly polluting or use animal testing for example may still be included. Often an approach is taken to invest across most industries/sectors and essentially invest in those companies that demonstrate good ESG attributes compared to their peers.

Dark ESG Investing

These investments have very rigid ethical and environmental investment standards. This may include excluding all stocks that even have tangential relationship with tobacco, weapons, gambling, animal testing, fur, adult entertainment, child labour etc.

Further, investment in companies may be limited to those that actively seek to improve the environment, social benefits or good corporate governance.

Considerations with ESG Investing

There are a number of factors that need to be acknowledged when building an ESG portfolio that clients should be aware of. There are also some myths as well. Here are some of the more significant considerations.

Diversification

By the very nature of ESG investing, companies will be excluded from portfolios. This has led to some commentators stating that portfolios are less diverse both on a holding, geographic and sector basis.

However, this is not always the case and a high level of diversification can be achieved to the point where the differences become insignificant. Let us look at the two of the most commonly used ESG and non-ESG international indices/benchmarks. For ESG, this is the FTSE ex Australia Global Choice Index Series which excludes companies involved in Vice Products (Adult Entertainment, Alcohol, Gambling, Tobacco), Non-Renewable Energy (Nuclear Power, Fossil Fuels), and Weapons (Civilian Firearms, Controversial Military Weapons, Conventional Military Weapons). For non-ESG this is the MSCI World ex-Australia Index.

Number of Companies

| Index | Number of Companies |

| FTSE Developed ex Australia Choice Index | 1632 |

| MSCI World ex-Australia Index | 1520 |

Here, we can see the actual number of company holdings is higher than the traditionally used MSCI index.

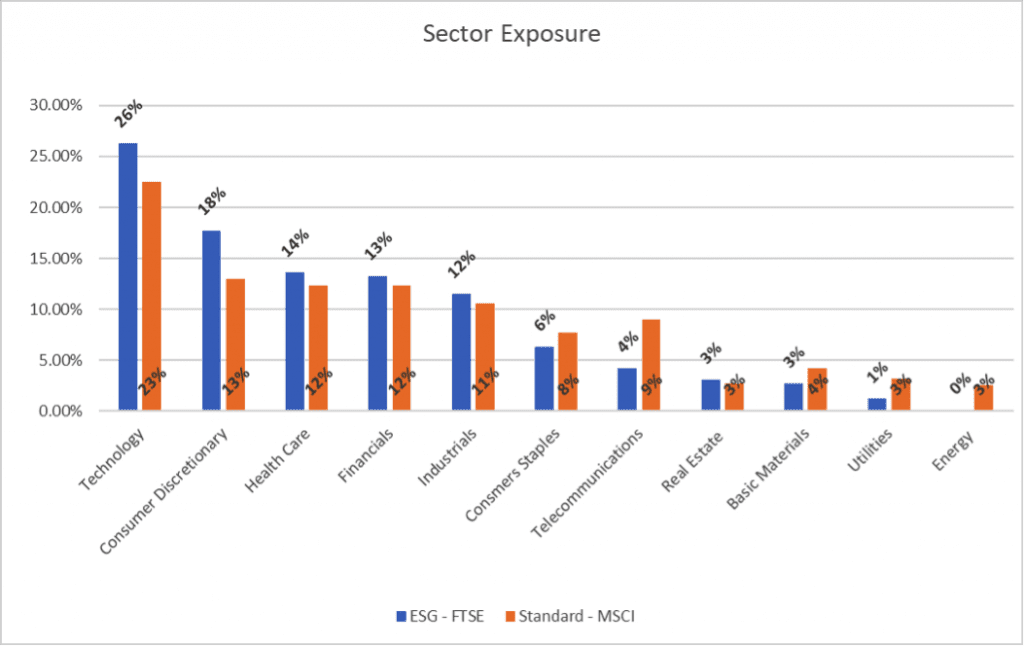

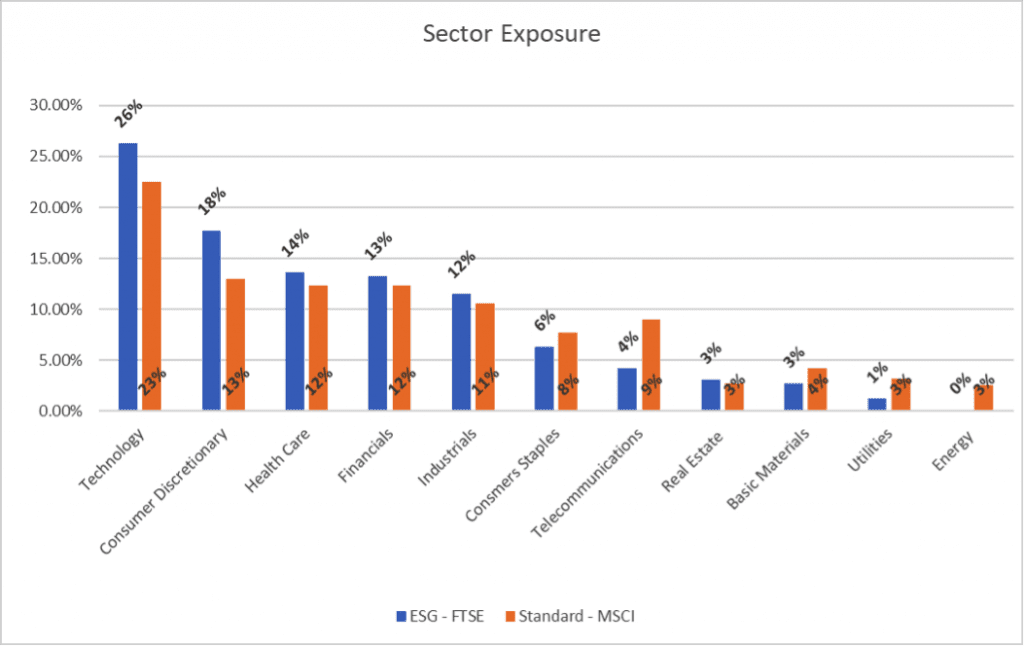

Sector Diversification

From the below chart we can see a slightly higher concentration of exposure to telecommunications, consumer discretionary and technology stocks in the ESG portfolio which compensates for the lower exposure to energy and basic materials stocks. Other sector differences are relatively insignificant, and a high level of sector diversification can still be achieved.

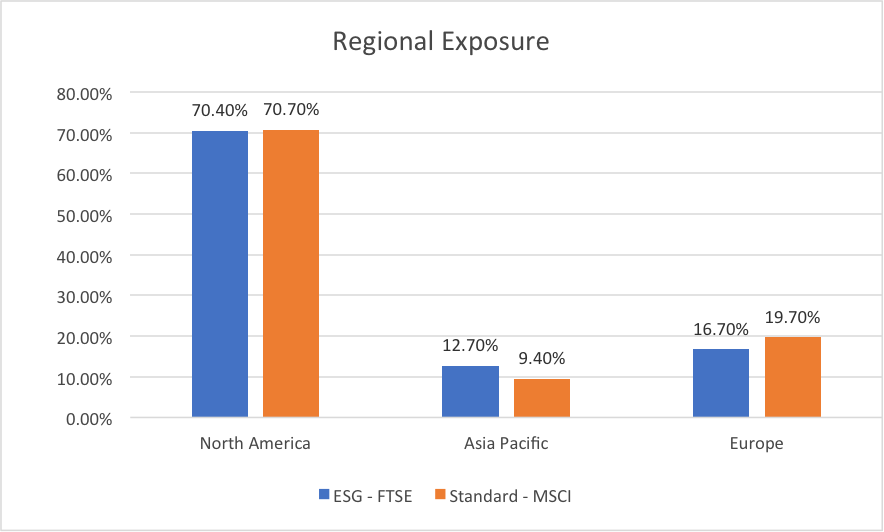

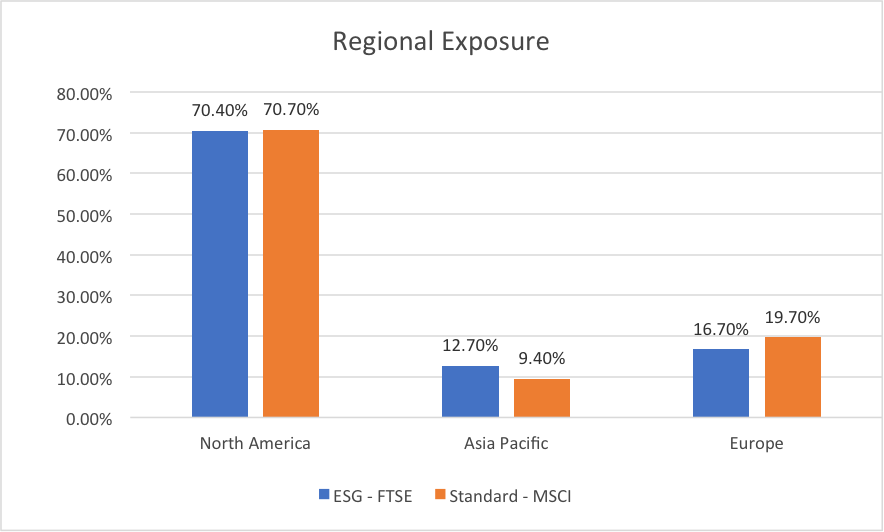

Geographical Diversification

The chart below shows us there is little different in regional diversification:

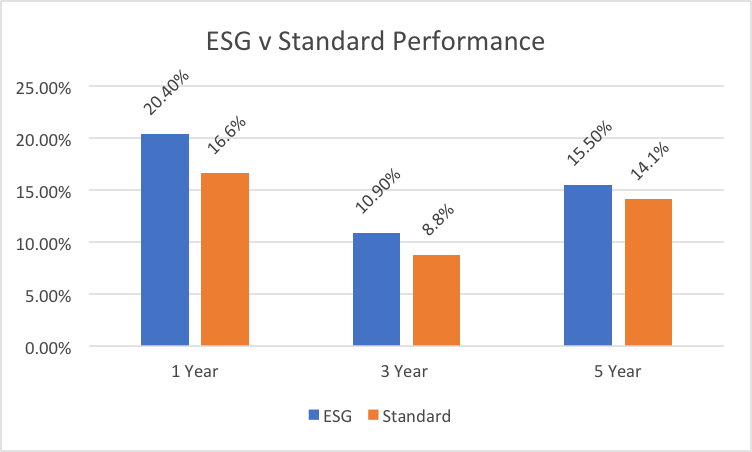

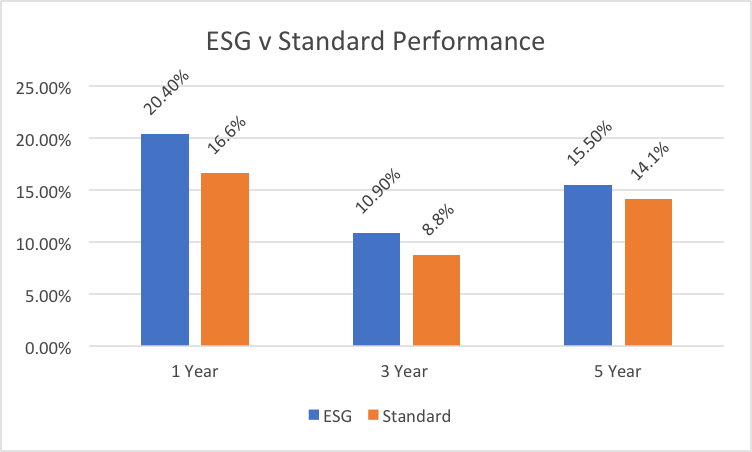

Performance

ESG investing does not need to come at the expense of portfolio investment returns. There is plenty of evidence to suggest that companies with good ESG attributes actually provide shareholders with superior long-term returns. A study from Morningstar examining 745 ESG funds found that the majority of those funds outperformed their non-ESG peers over 1-, 3-, 5- and 10-year periods.[1]

Let’s look at two indices, one ESG and one non-ESG. For this exercise I have chosen the FTSE Developed ex Australia Choice (ESG) and the FTSE Developed ex Australia (non-ESG) rather than the MSCI, so index methodology is comparable. We can see the ESG portfolio has provided consistently higher returns:[2]

A recent study undertaken by Calvert Research & Management commissioned by Barron’s (for the fourth time) to rank the top 100 most sustainable US companies found that in the calendar year 2020 those top 100 sustainable companies outperformed the S&P500 by 6.9%. Over a three-year period that outperformance was 5.6% p.a.[3]

[1] Riding, S. (2020). Majority of ESG funds outperform wider market over 10 years. Financial Times.

[2] Performance as at 31 January 2021.

[3] Norton, L. (2021). The 100 Most Sustainable Companies. Barron’s.

Costs

Historically, ESG portfolios have had significantly higher management fees and for some funds this is still the case, which is somewhat perplexing that high fees seem acceptable to such managers whilst seeking to maintain their ESG credentials. Nonetheless, there are now many experienced fund managers entering the ESG space with new managed funds and exchange traded funds (ETFs) where pricing is comparable to non-ESG portfolios. At Killara Wealth we can typically construct a variety of ESG portfolios for clients between a range of 0.20% – 0.80% dependent on client goals and risk profiles (the exposure of growth and defensive assets in a portfolio).

Summary

If you are looking for more sustainable investment options, with care and professional advice, you can achieve similar levels of diversification compared to non-ESG portfolios and this does necessarily need to come at the expense of additional fees or compromising investment returns. If you would like to discuss reviewing your superannuation or investment portfolio to focus on more sustainable investing or to align your investments to your own ESG values, please contact us.