Pricing financial advice should not be a one size fits all approach. At Killara Wealth we price advice according to complexity and the time we expect it to take to prepare and implement the advice for you. We believe our pricing structure, which is pure fee for service, is the fairest for clients and removes unnecessary conflicts of interest from providing advice. At Killara Wealth, we do not charge asset-based fees on investments or recommend insurance products where there is commission payable.

Typical Costs for Advice

The total cost of financial advice should not be assessed just on what is paid to your adviser. Rather, it should be the overall cost of advice plus product fees and commissions, which can be significant as you will see below. The Financial Planning Association of Australia in a member research survey in 2019 found that on average, FPA members charge $2,671 to prepare a financial plan and $3,757 per year for ongoing advice to clients.

At Killara Wealth, we approach things a little differently, we firmly believe that whilst reviewing your financial plan and receiving ongoing advice is important, we feel that if things are set up properly in the first place then the cost of ongoing advice should be less than the initial cost. In some cases, once a client is on the right path then they may not need extensive, ongoing, regular advice and may just wish to check in with us every couple of years or if and when circumstances change.

Pricing Fee for Service Advice

Killara Wealth’s base fee for service advice for a single person is $2,200 and for a couple is $3,300. This fee covers a typical retirement plan where advice is required on a defined benefit fund (CSS, PSS, DFRDB, MilitarySuper etc), a standard accumulation superannuation fund, cashflow, tax, capital and Centrelink (where applicable) projections. For the public sector, this type of plan typically meets the needs of the majority of clients.

Fees may increase where there are investment property portfolios to consider, life insurance, non-super investment portfolios, self-managed superannuation funds and family trusts. These additional considerations all take time to research and model. Irrespective of your circumstances, we will provide you with a fixed price quote before you proceed with any advice. That way you will know exactly where you stand.

In most of the advice we provide, we find that the fees charged are more than offset in the first year by fee and commission savings on products and tax savings from thew strategies implemented.

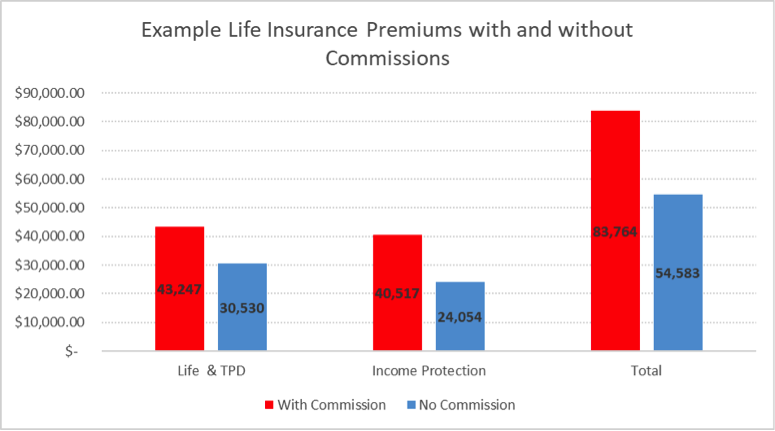

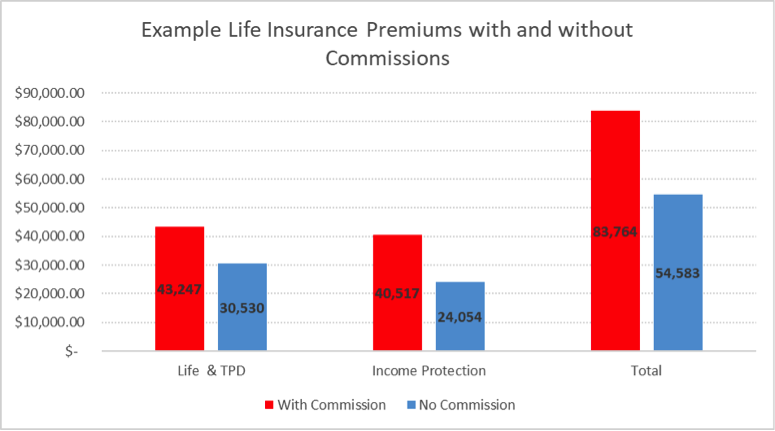

For example, we do not charge asset-based fees. Asset based fees are a percentage fee charged on the total value of the assets in your portfolio (investments and superannuation). We believe these are not in the best interests of clients as it may skew the advice towards recommending more investments and superannuation as opposed to other strategies such as paying down debt. We also do not charge commission on life insurance products recommended. Once again, we believe commissions are not in the best interests of clients as there is the perverse incentive to recommend high levels of cover and high premiums as this is what the commission paid is based upon.

Pricing the Total Cost of Advice Needs to Include the Cost of Products

The cost of your initial financial plan is not the only consideration when assessing overall value of the advice provided. The cost of insurance premiums as well as investments should also be assessed along with how complex the advice and product recommendations are. Generally, the more complex the investment or insurance portfolio recommended the more often it will require reviewing and this can have a significant impact on the value of the overall advice provided.

By choosing an adviser who refunds or rebates commission on insurance recommendations means you will typically save 20 – 30% annually on the cost of your insurance premiums and that is for the life of the policy!

Let’s now look at putting the costs of a financial plan in context with some of the potential savings that could be made. In this scenario, we have a 45-year male working in the Australian Public Service. Assuming $1,000,000 of Life and Total and Permanent Disablement cover and $8,000 per month income protection cover. The annual premium with commissions through a large Australian insurance company would be $3,611. Without commissions the same cover would cost $2,553 a difference of 29%. If premiums for the cover were paid up to the age of 55 the difference would be $29,181 over the 20-year period:

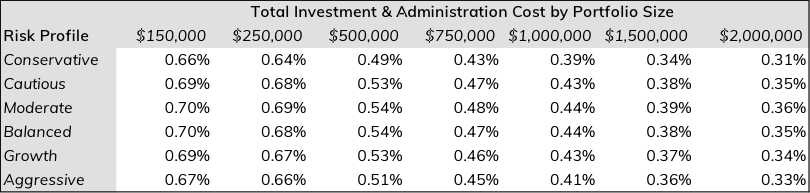

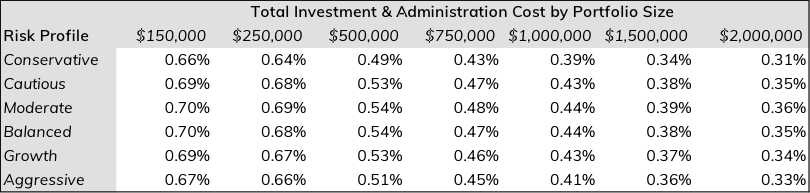

By choosing an adviser who is able to implement low cost investment portfolios for you, and does not charge asset-based fees, means you may be able to save upwards of up to 1% p.a. on the cost of running your investment or superannuation portfolios. Killara Wealth can provide investment and superannuation portfolios for as little as the following:

The above portfolios have typically outperformed competitors at a fraction of their cost and are generally more tax effective. One of the natural advantages of course is that lower fees drop straight to the bottom line in terms of investment returns. For example, the median fee for a balanced superannuation fund in Australia is 1.25% for a $250,000 portfolio. We can construct a balanced superannuation portfolio for as little as 0.68%, some 45% lower in cost.

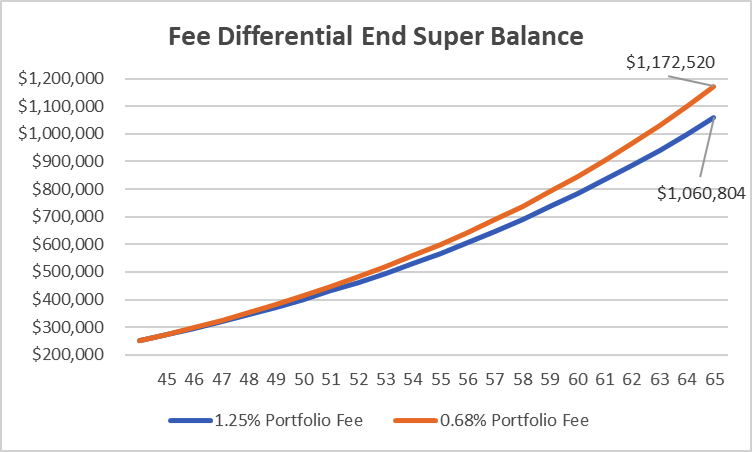

To quantify this, let us go back to our example of a 45-year-old male working in the Australian Public Service and retiring at age 65. Assuming they are salary sacrificing $10,000 p.a., and already have $250,000 in their superannuation accumulation account, that fee differential of 0.57% would make a $111,716 difference to their retirement lump sum at age 65:

From the examples above, you can see how seemingly “small” differences can add up to a very significant amount of money at the point of your retirement. And in most of the advice we provide, we see our clients’ fees for service are more than offset in the just the first year! If you’d like to know about the financial planning process, check out this article.

At Killara Wealth we fundamentally believe and ensure that every financial plan we produce clearly demonstrates how clients can meet their objectives and explain investments and strategies in plain English. We keep things simple wherever possible as reducing the complexity of the advice makes it easier for you to understand and manage without excessive ongoing advice fees. If you would like to see how the numbers could work in your favour, I offer a complimentary15-minute phone appointment to discuss your needs. You can book here in just a few clicks.