As part of any financial advice process, an essential ingredient is understanding your investor profile. This is usually ascertained from completing a risk profile questionnaire to assist your understanding of your attitude to risk. However, a questionnaire should not be the only thing driving your investor profile.

An understanding of how the expected returns of different investment portfolios will impact you achieving your financial goals is also fundamental. For example, you may need to take more risk in your portfolio to achieve a higher return to meet your goals. Alternatively, you may already have sufficient assets so you do not need to take a large amount of risk, although you may still wish to take risk in your portfolio in order to further build wealth.

What is Risk?

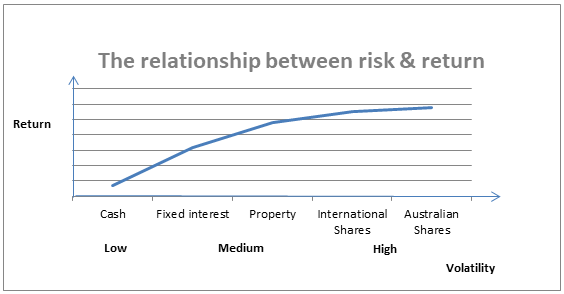

Investment returns from capital growth assets such as shares or property are more volatile than returns from, for example, fixed term deposits. However, the reward for taking a higher degree of risk is generally a higher return over the long-term.

Not everybody is comfortable taking a risk. However, being too conservative also involves the risk that your capital will not keep pace with inflation and the purchasing power of your capital and long-term income may steadily decline.

An investor who seeks higher returns and is prepared to accept a higher degree of volatility, will generally have a portfolio with a high proportion of Australian, international shares and property. On the other hand, a risk averse investor, prepared to accept only low investment risk, would have a portfolio with a large proportion of fixed interest and cash investments, which offer comparatively lower risk but also lower returns. This structuring of investment classes to meet a client’s risk profile and financial objectives is referred to as asset allocation.

Diversification

For all the so-called expertise and research about the business cycle and domestic and international economies, no one really knows when or to what extent various asset classes will be positively or negatively impacted by certain events.

For this reason, it is important to diversify. By diversifying across both investments and asset classes, your portfolio is at least partly protected when another investment or asset class suffers. Simply, the key is to construct a portfolio that has a sufficiently diverse selection of assets that do not perform well or badly at the same time.

Timeframes

How long your funds are invested is also a critical factor in determining your investor risk profile. Irrespective of your appetite for risk, a large skew to growth assets may be inappropriate if you need your funds in the short to medium term, for example accessing some of your superannuation to pay off debts upon your retirement or to fund planned expenditures such as a new car or home renovations.

Fortunately, volatility reduces over time, so you can tolerate a higher degree of volatility of you have a longer time frame for investing. This is because your investments have more time in the market to recover in the instance of market downturns.

Definitions of Timeframes:

Short-term: 0 – 2 years. Medium-term: 2 – 5 years. Long-term: 5 years and beyond.

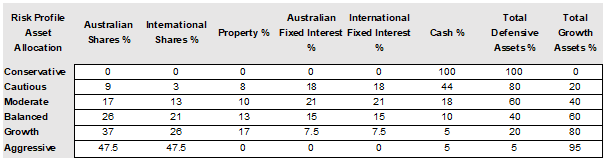

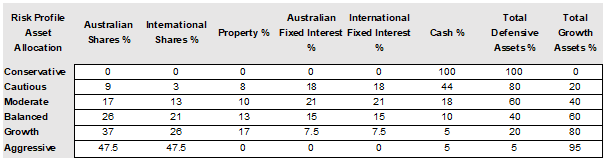

Asset Allocation and Typical Investor Risk Profiles

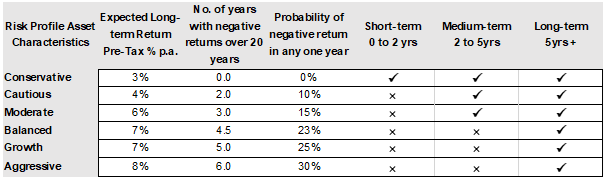

Applying the above logic, we generally determine people are one of 5 risk profiles as per the below table:

Source: MFG Advice

The characteristics of these portfolios in terms of expected returns and risk are as follows:

Whilst theoretically those averse to negative returns could remain invested in Conservative, Cautious and Moderate portfolios there is of course the greater risk that either their capital is eroded by inflation or they in fact outlive their capital. This risk is referred to as longevity risk. Often, people make the mistake of thinking their investment time frame is up to their retirement. However, in most cases some of that capital should remain invested for decades to come to at least meet one’s life expectancy.

Longevity Risk

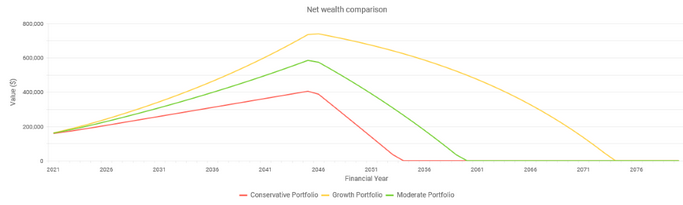

Let us look at a practical example of longevity risk. Sarah Sample is age 40 and she currently has $150,000 in super. Her income is $100,000 p.a. and she wants to retire at age 65 on an income of $50,000. As a 40-year-old female her life expectancy is 86 years. We look at three different scenarios where she is invested both now and in retirement in a Conservative, Moderate or Growth portfolio.

Under the conservative scenario Sarah runs out of super at 76 as a Conservative investor, 80 as a Moderate investor and 94 (well beyond her life expectancy) as a Growth investor. Under the first two portfolios Sarah’s capital will run out prior to her life expectancy and is an example of longevity risk. Longevity risk must be considered when determining one’s risk profile.

In Summary

The fear of negative return for some people can persuade them to be more conservative than they should be. For others sorting out what lump sum expenditure is required at retirement and what will be left over can prove confusing as to how they should be invested overall. This is where the benefit of good financial planning helps. By working out what income is required along with planned and prioritised expenditure goals/requirements along with taxation, age pension, other superannuation lifetime pension such as CSS and PSS considerations it is possible to confidently work out how you should be invested rather than where you think you should be.

If you would like help mapping out your financial future, expenditure and retirement please contact Killara Wealth today and book in a complimentary initial meeting. Also remember to subscribe to my newsletter to ensure you receive my articles directly.